What Is Double Entry Bookkeeping?

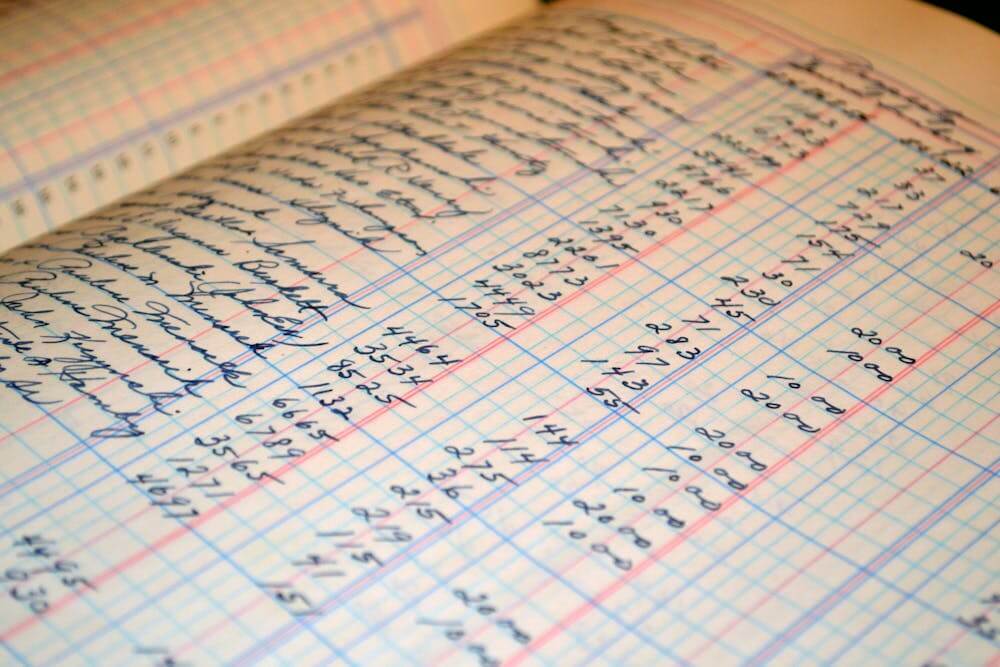

Double entry bookkeeping is a core accounting system used by businesses to maintain accurate and organized financial records. Unlike single-entry bookkeeping, which records transactions only once, double entry bookkeeping records every financial transaction twice, once as a debit and once as a credit. This ensures that the accounting equation Assets = Liabilities + Equity always remains balanced, providing a clear picture of a business’s financial health.

By recording both sides of a transaction, businesses can track exactly where money comes from and where it goes, making it easier to detect errors, prepare financial reports, and make informed decisions. It is widely used by accountants, bookkeepers, and business owners who want transparency, accuracy, and compliance in their financial operations. Many companies also rely on professional bookkeeping Houston services to implement and manage double-entry bookkeeping efficiently.

How Double Entry Bookkeeping Works

In double entry bookkeeping, every transaction impacts at least two accounts. Each transaction has a debit entry and a credit entry, which must always balance:

- Debit: Represents an increase in assets or expenses, or a decrease in liabilities, equity, or income.

- Credit: Represents an increase in liabilities, equity, or income, or a decrease in assets or expenses.

For example, if a company purchases office equipment worth $1,000 in cash:

- Debit: Office Equipment account $1,000 (asset increases)

- Credit: Cash account $1,000 (asset decreases)

This ensures the total debits always equal total credits, maintaining a balanced ledger.

Examples of Double Entry Transactions

The MadTax uses double-entry bookkeeping, a widely used accounting system for recording various types of financial transactions accurately and systematically.

Purchasing Inventory on Credit

Debit: Inventory account

Credit: Accounts Payable

Receiving Customer Payment

Debit: Cash/Bank account

Credit: Accounts Receivable

Paying Salaries

Debit: Salary Expense

Credit: Cash/Bank

These examples demonstrate how every financial activity is systematically recorded, providing a complete and accurate record of a business’s finances. This method ensures consistency, prevents errors, and enhances financial transparency for informed decision-making.

Benefits of Double Entry Bookkeeping

Double-entry bookkeeping offers several advantages for businesses, making it easier to track transactions accurately.It helps maintain balanced records and supports better financial decision-making:

- Accuracy and Reliability

Recording transactions twice minimizes errors, ensures consistency, and provides a reliable view of financial health.

- Error Detection

Since debits must always equal credits, any imbalance immediately signals a mistake, making it easier to identify and correct errors.

- Detailed Financial Reporting

Businesses can easily generate income statements, balance sheets, and cash flow reports, which are critical for decision-making.

- Compliance and Audit Readiness

Double entry bookkeeping aligns with accounting standards and is required for audits, tax filings, and regulatory compliance.

- Improved Decision-Making

Accurate records help business owners analyze financial performance, plan budgets, and allocate resources effectively.

Double Entry vs. Single Entry Bookkeeping

While single-entry bookkeeping records each transaction only once, typically in a cash book, it is less comprehensive and prone to errors. Double entry bookkeeping, on the other hand, provides a complete financial picture, allowing businesses to track assets, liabilities, equity, income, and expenses systematically.

| Feature | Single Entry | Double Entry |

| Records | Once | Twice (Debit & Credit) |

| Error Detection | Limited | High |

| Financial Statements | Basic | Detailed |

| Compliance | Not ideal | Audit-ready |

For businesses aiming for accuracy, transparency, and regulatory compliance, double entry bookkeeping is the preferred system.

Common Accounting Software for Double Entry Bookkeeping

Modern technology has simplified double entry bookkeeping. Accounting software such as QuickBooks, Xero, FreshBooks, and Sage automate the recording process while maintaining the integrity of the debit-credit system.These tools help businesses:

- Record transactions accurately

- Reconcile accounts automatically

- Generate real-time financial reports

- Reduce human errors and save time

Even with advanced software, understanding the principles of double entry bookkeeping is essential to ensure accuracy and oversight.

Why Businesses Need Double Entry Bookkeeping

Double entry bookkeeping is essential for maintaining financial accuracy and supporting business growth. It ensures:

- Complete and balanced financial records

- Reduced risk of fraud and errors

- Compliance with tax and regulatory requirements

- Easier preparation for audits or loans

Businesses, especially growing ones, often rely on professional business bookkeeping services to implement and maintain double entry bookkeeping. These services ensure that financial records are accurate, organized, and up-to-date, allowing business owners to focus on growth.

Take Your Business Finances to the Next Level

Understanding double entry bookkeeping is crucial for business owners and finance professionals. By recording transactions in both debit and credit accounts, businesses maintain balanced ledgers, prevent errors, and gain a clear view of their financial position. Implementing this system, whether manually or through software, ensures long-term financial stability and operational success.

Professional business bookkeeping services can help streamline your bookkeeping process, manage complex transactions, and keep your financial records compliant and reliable. With accurate double entry bookkeeping, your business can make smarter financial decisions, stay audit-ready, and grow with confidence.